Investing In Rare Metals

By-Product Effect: Low price elasticity of supply

The numbers given in this video are estimates only, and are not intended accurately to represent current prices and production volumes.

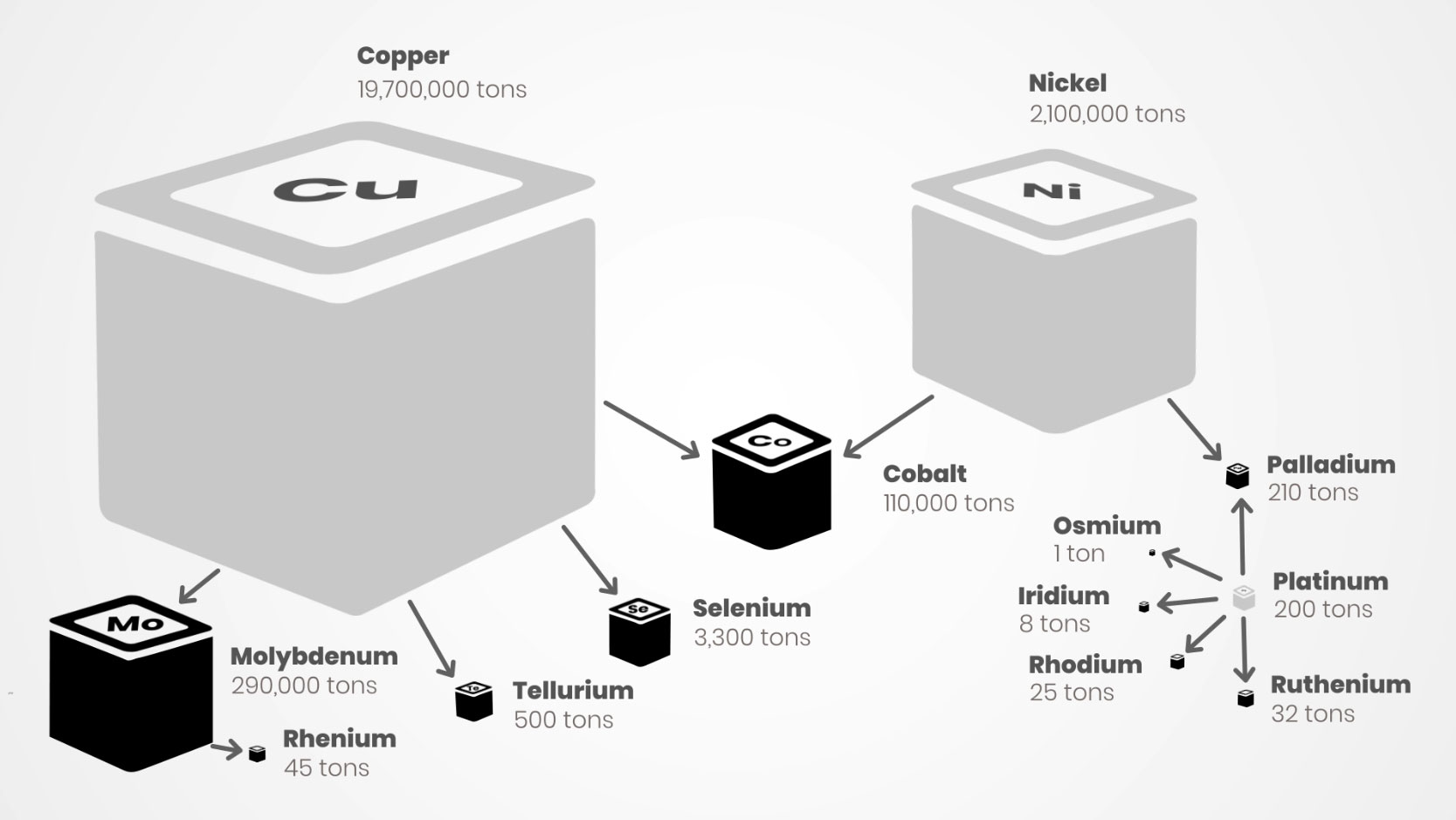

Base metals such as copper and nickel, and precious metals such as platinum, are directly targeted by mining companies and produced as a primary product, whereas rare metals such as tellurium, cobalt or ruthenium are – for the most part – produced as by-products of the base and precious metals industries. As such, they have a low price elasticity of supply.

The by-product nature of the metals in our investment universe, together with rapidly evolving industrial needs, can lead to serious shortages and significant, rapid price movements.

Substitutability: Low price elasticity of demand

If a rare metal’s specific physical properties make it critical for a given application, then avoiding it would necessarily lead to huge efficiency losses, or even to the complete inability to produce that particular technology. Industrial players therefore cannot usually afford to substitute critical rare metals in the short term, meaning that the latter have a low price elasticity of demand.

Below are three instances of physical properties exploited in rare metals. This is by no means an exhaustive list. Ruthenium for example is used not just as a semiconductor in microelectronics, but also as a catalyst in the oil industry, as an anti-corrosion agent in hard drives, and in strengthening titanium alloys… and further applications are constantly being developed for this terrifically versatile metal.

Semiconductor

SemiconductorProperties

Refractory

RefractoryProperties

Electrochemical

ElectrochemicalProperties