Rhenium is a metal whose atypical refractory properties lend it undeniable intrinsic value. And although the prices of rhenium compounds have been falling since 2008, rhenium remains essential for the aerospace industry, which should continue to use it in aircraft engines for many years to come. Therefore, since rhenium prices now stand at an all-time low, this metal has definite long-term investment potential.

Demand

Since it is so largely dependent on the aeronautics industry, the demand for rhenium has been severely disrupted by the COVID-19 crisis. And the oil industry, which also uses rhenium for catalysts, has also been severely affected.

Nevertheless, the number of air passengers could reach pre-COVID levels again within three to four years. Air traffic could also double by 2040 according to manufacturers Airbus and Boeing, making aeronautics a sector with strong growth in the medium to long term.

Demand for other applications requiring rhenium compounds, catalysts and gas turbines in particular, should return to a stable level in the medium term, with no prospect of significant growth.

The level of demand for rhenium will therefore largely be set by the aeronautics industry, whose share of total rhenium consumption is expected to increase further in the years to come.

Furthermore, the environmental challenges facing the aeronautics industry should encourage airlines to favour more recent aircraft designs using alloys with a higher proportion of rhenium.

Finally, growing geopolitical tensions and booming military budgets around the world also support the growing use of rhenium.

Supply

The production of primary rhenium has fluctuated between 37 and 52 tons per year since 2003. Between 2015 and 2018, annual production remained at roughly 45 tons.

Rhenium production is concentrated in Chile, which alone accounted for 56% of global rhenium production in 2018. And rhenium production capacities are concentrated on a corporate as well as a geographical level: The mining company Molymet accounts for close to half of global production.

Codelco’s Molyb sector has also been a recent producer of rhenium since 2016 in Chile, with lower capacities (up to 3 tons per year). The United States (Freeport McMoRan), the world’s largest consumer, Poland (KGHM) and Kazakhstan account for most remaining primary production with 18%, 14% and 3% of production respectively (in 2018). China and Russia also produce some rhenium, but production data is imprecise.

Rhenium is produced exclusively as a by-product of molybdenum and copper. Therefore, production levels for rhenium are determined to a large extent by the production levels for those two metals. Consequently, rhenium has a low price elasticity of supply.

Recycling is also a key factor in the supply of rhenium, since around 20 tons of rhenium per year come from secondary production (excluding catalysts which are recycled and directly used in a closed cycle). This secondary production is expected to contract in the short term following the closure of Umicore’s recycling plant in Wickliffe, which produced around 7 tons of rhenium per year. Another challenge is that the recycling of rhenium has been becoming less and less economical due to prices that have been falling since 2008.

In summary, rhenium supply is expected to decline in the short term, following the COVID-induced slowdown in mining activity for molybdenum and copper, as well as a decrease in secondary supplies.

Market & Outlook

Unlike other more common metals, rhenium is not publicly listed. Most contracts on rhenium compounds are long-term agreements running over several years, for example between a producer and an aircraft engine manufacturer. This was the case in 2014 when a long-term contract worth $690 million was signed between Molymet and Pratt & Whitney.

There are also intermediates able to supply rhenium compounds from time to time depending on the characteristics of the compounds requested. Finally, physical purchase is also a possibility.

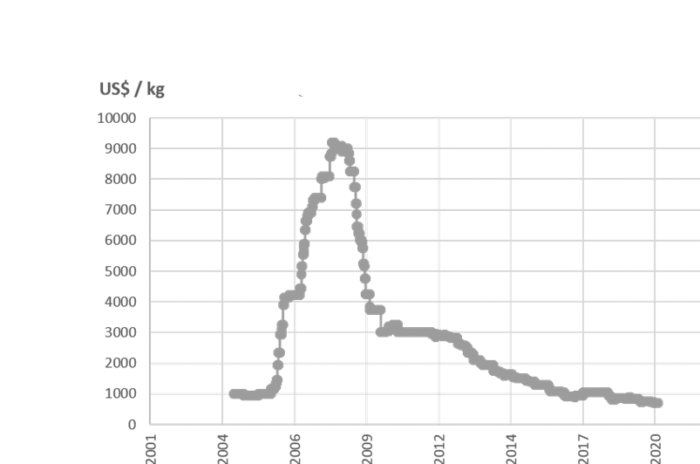

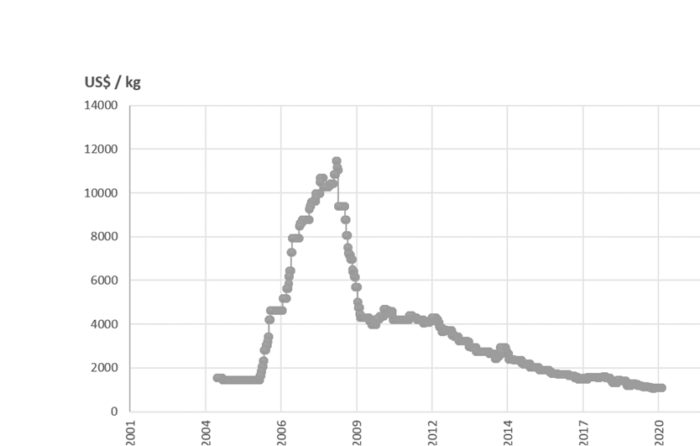

Rhenium compounds are currently posting their lowest prices on record. Ammonium perrhenate (APR) is trading at 700 $ / kg, miles away from the 9,000 $ / kg reached in 2008. Similarly, rhenium metal is now trading at around 1,096 $ / kg despite it having approached the $ 11,500 / kg mark in 2008. Here are the historical prices for RPA and rhenium metal, published by Argus Metal:

June 2004 – July 2020

Source: Argus Metal

June 2004 – July 2020

Source: Argus Metal

Although some aircraft manufacturers such as Snecma (a subsidiary of Safran) have attempted to eliminate rhenium from their alloys after soaring rhenium prices in 2008, rhenium remains a widely used and essential metal for aircraft engines. It is all the more critical for military aviation, which could not do without its refractory properties.

In the short term, the demand for rhenium is likely to suffer from the difficulties of the aeronautics sector and to experience a notable slowdown.

However, the consumption of rhenium should be boosted by aeronautics in the years to come because it is the only demand sector with a real prospect of significant growth. Indeed, the aeronautics sector has grown faster than world GDP in the last ten years (6.8% vs 3.3%).

In addition, since rhenium is mainly extracted as a by-product of copper (the production of which is correlated with global growth) the price of rhenium could increase due to supply pressures if the aeronautics sector keeps requiring alloys with a high content of rhenium, as they are today.

Uncertainties remain in the medium term, particularly with regards to possible future engine technologies (open rotor engines, hydrogen engines, electric engines, biofuel engines, hybrid engines) whose rhenium consumption levels are hard to predict. However, if one takes into account the fact that rhenium provides better energy efficiency than any other metal in components operating at high temperature, then rhenium appears to be a key metal for the energy transition.

Investing in rhenium could therefore prove to be a wise choice for any investor aiming for real added value in the long term.

Sources

- L’élémentarium, fiche de l’élément rhénium, 2019.

- BRGM, Panorama 2010 du marché du rhénium, Septembre 2011.

- Argus Metal, 2020.

- USGS, 2020.

- Lipmann Walton & Co Ltd, Rhenium, 2020, https://www.lipmann.co.uk/rhenium.

- Franck Nozahic, Elaboration par Spark Plasma Sintering et caractérisation de composites et multi-couches zircone yttrié/MoSi2(B) pour application barrière thermique auto-cicatrisante, DOI: 10.13140/RG.2.2.28248.60169, 2016.