The green industrial revolution, driven by massive new levels of private and public investment, and by the tightening of emissions regulations among other factors, is currently impacting the markets for several of the key green energy metals in the CDMR portfolio. At the start of a year of great economic uncertainty, here’s our account of the forces that will affect the metals needed for the decarbonisation of tomorrow’s world.

Platinum Group Metals (PGMs)

Platinum Group Metals (PGMs), a group of metals that includes ruthenium, rhodium, palladium, osmium, iridium, and platinum, are essential for a wide and ever-expanding spectrum of industrial applications.

Rhodium, that rarest of PGMs, is essential for the treatment of nitrous oxides produced by combustion engines. The tightening of emissions regulations, in China among other countries, has triggered a surge in its demand, while its structural supply deficit (resulting from chronic under-investment in the South African platinum mines from which rhodium almost exclusively originates) was only exacerbated this year by a Covid-induced fall in production.

After investing in rhodium back in 2014, we sold our position in rhodium in January 2020 following a seven fold increase in its price since purchase.

Still, we couldn’t have predicted at the point of sale that Anglo American Platinum was going to close its ACP phase A converter plant following an explosion in its unit A converter on February 10th. And come March, water was detected in the unit B furnace, resulting in further risk of explosion.

The ensuing decision to shut down unit B forced Anglo American Platinum to halt its mineral refining processes and declare a force majeure. The works required to restore the plant to a functioning standard, together with lockdown measures that put a stop to all mining activity for several weeks during the spring, greatly impacted the production of PGMs throughout the year.

On no market was the impact of these events felt more strongly than on that of rhodium (of which 80% comes from South Africa), the aforementioned effects being compounded by rhodium’s rarity and the long time the metal takes to be refined. Having sold our rhodium stock at a good price (the previous historic record was 10,000 USD/Oz) we chose not to buy any more of it since the risk of a market downturn in the event of a return to normalcy felt too great.

We did on the other hand hold on to our position in ruthenium. To invest in ruthenium has turned out to be a wise and timely choice: We strongly believe in this metal’s potential (for electro-chlorination of ballast water, electronics, and hydrogen energy among other applications).

The smaller size of the ruthenium market compared with that of rhodium (1.5 times smaller in volume and 10 to 15 times smaller in value) meant ruthenium prices reacted less strongly to the South African output crisis. And since the start of 2021 ruthenium prices have been rising. Ruthenium’s price elasticity of demand, which is lower than that of other PGMs, only enhances our faith in its potential.

With regards to other PGMs however, the news is more mixed. A new technology developed by BASF could pave the way for a partial replacement of palladium with platinum in the catalytic converters of combustion engines. This could uphold the demand and therefore the prices for platinum, to the detriment of palladium prices.

On the other hand, while the much-anticipated rise of hydrogen power (see previous blog) should boost platinum demand, it appears that cobalt substitution could be a game changer. Researchers from the Pacific Northwest National Laboratory in the US have announced their development of a high-performing catalyst that combines cobalt with nitrogen and carbon, and that therefore no longer requires platinum to facilitate the chemical reaction producing hydrogen from water.

If this tech is successful, it would be a massive blow to platinum demand (but a great leap forward for hydrogen tech).

And so we are remaining very cautious: Current levels of innovation and investment in the field of hydrogen power are simply too high for us to be able to place precise, informed bets today that go beyond a broad faith in surging demand.

Silver

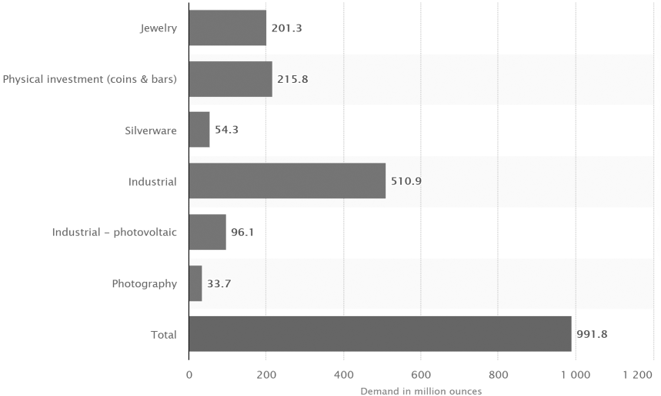

Things are looking doubly positive for silver. Firstly, as a precious metal, its value as a secure investment is being bolstered by the monetary and economic uncertainty prevalent in the current crisis. And secondly, silver’s industrial and technological applications are multiplying.

According to CRU Consluting, a key reference in metals research, demand for silver for the growing solar energy sector could reach 888 million ounces by 2030, 90% more than total global production in 2019. Additionally, the roll-out of 5G will still further increase the demand for silver in electronics.

Ferro-alloys

Broadly speaking, ferro-alloy prices have bounced back in recent months thanks to the resumption of Chinese industrial activity. This has been good news for ferro-tungsten investment and for ferro-vanadium investment. However, recent stockpiling on the part of Chinese steelmakers, together with the second wave of the pandemic, could imperil this positive trend. Visibility is therefore rather low with regards to short term demand.

Cobalt

Lithium, copper, nickel and cobalt have all received considerable press recently as green battery metals whose rise is being watched by investors with great interest.

However, despite cobalt prices having benefited recently from a rise in demand for EVs, there’s still a long way to go to beat 2018 prices (39,000 USD/ton at Jan 21st 2021 versus 95,000 USD/ton at the 2018 peak). Therefore to invest in green battery metals such as cobalt may still represent a significant opportunity in 2021.

It is worth noting that according to Roskill, China’s National Food and Strategic Reserves Administration has stockpiled 5,000 tons of cobalt over the last year (equating to 3.5 – 4% of worldwide production).

Nevertheless, as for silver, CDMR increased its position in cobalt at a good price and remains confident in its upturn potential.

Note: These blog articles will be the last to make publically available our specific analyses of rare metals markets, and related forecasts regarding rare metals investing. From April 2021, all new quarterly analyses and forecasts will be available only to our investors and paying subscribers.