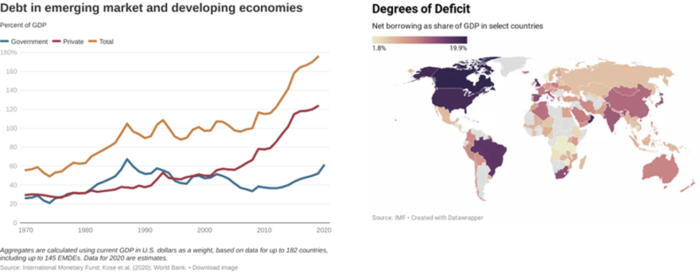

While it may still have been possible to question the sustainability of global debt after the 2008 crisis and the repeated QEs that followed it, we at CDMR believe that its unsustainability is now beyond doubt.

The current crisis is far from over. The new Covid variants, and the increasingly volatile politics surrounding vaccine deployment, hint to a rocky road ahead. And while we cannot yet fathom the depth of the economic damage that has been dealt by this virus and by our responses to it, both nations and private businesses are already facing a disastrous predicament.

The prospect of a vicious cycle driven by mass redundancies and bankruptcies paints a bleak picture of our economic future. One way or another, a great “reset” seems inevitable. On this subject, it is worth remembering the words of Jeroen Dijsselbloem, then president of the Eurogroup, during the Cypriot crisis that culminated in mass confiscation of private savings:

“The rescue programme agreed for Cyprus on Monday represents a new template for resolving Euro zone banking problems.”

The recent words of the IMF’s European director echo this sentiment: “Debt in France is high and we believe the time has come to develop and approve a credible medium-term fiscal consolidation plan.” Our chickens are coming home to roost, and this is true of France but also of other Western countries, the UK and USA first and foremost. Our debt levels, no matter the arguments we may articulate in their defence, can neither be sustained nor be repaid.

An unsustainable economic model will eventually reach a breaking point. Will this shock come in the form of inflation, hyper-inflation or monetary devaluation, or will we resort to confiscation and/or default? It’s impossible to say at the moment, but two more factors rendering a breaking point all the more certain are a) That the West is critically de-industrialised (and must therefore pay a high price for imports, and b) That the Dollar is being increasingly challenged as a global currency.

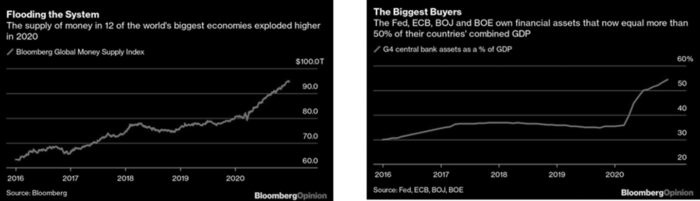

Since a rise in interest rates remains unthinkable for nations burdened with such high levels of debt, the fear of inflation (and stagflation) has therefore returned to haunt the financial sector. Such inflation would generate significant risk for the bond market, whose business model is perpetually to lower interest rates.

For stock markets on the other hand, the last twelve months have been light years removed from economic reality. For as long as baby boomer pensions need to be paid, and for as long as the Dollar enjoys its special status as a global currency, the Fed will carry on with its quantitative easing policy.

Challenging stock market performance is therefore a futile exercise for the time being – at least, it will be until the inevitable economic reckoning comes. For to quote Zweig quoting Shakespeare:

“So foul a sky clears not without a storm”

For now, let us leave what Zweig termed “The World of Yesterday” to discuss…

The World of Tomorrow

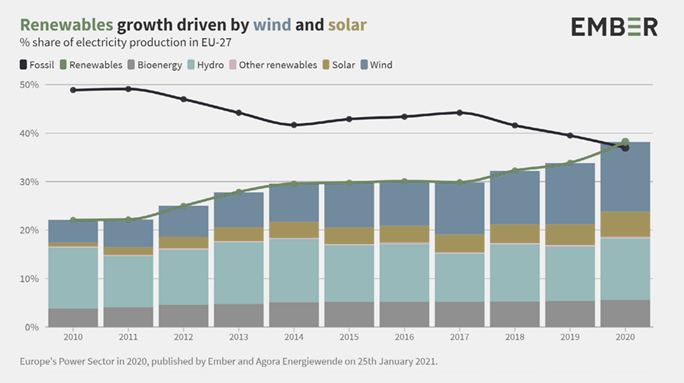

Not all is doom and gloom. The latest report from the British think tank Ember kicked off this year’s round of annual reports on energy production with a historic revelation: Last year in Europe, for the first time since the start of the industrial revolution, more electricity was produced from renewable sources than from fossil fuels.

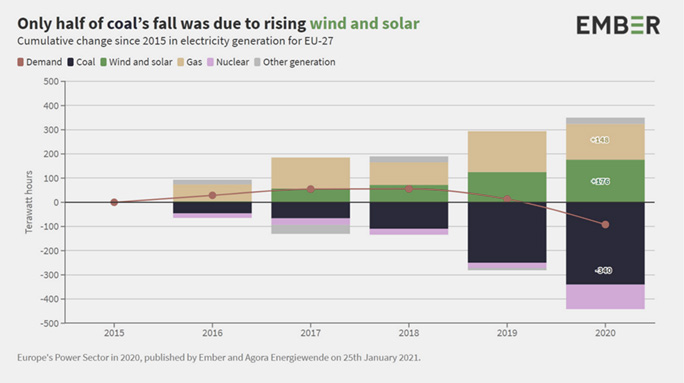

Of course, this needs to be put into context: Successive lockdowns in 2020 entailed a significant reduction in industrial and other activity (European electricity consumption fell by 4% in 2020). Nevertheless, the trend is unmistakable. Wind and solar, that were still marginal energy sources only a few years ago, have become (despite the persistent problem of intermittency) central pillars of our energy mix. Another encouraging fact is that we have halved our consumption of coal between 2015 and 2020, thanks to CO2 emissions costs, and to a steep drop in the price of natural gas.

Today, both wind and solar sectors are continuing to boom…

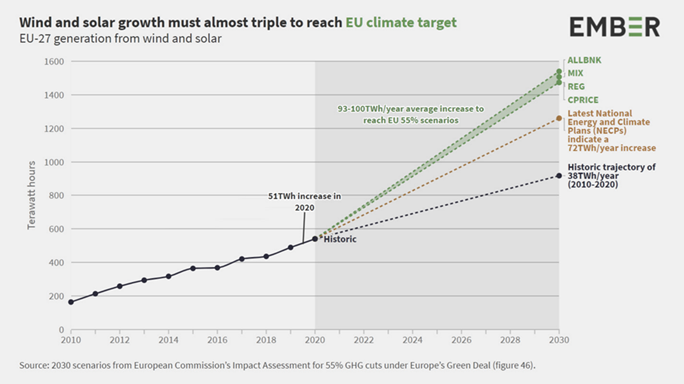

… but they will still need to triple their production if the EU is to meet its climate objectives.

This implies that our demand for rare metals (silver, indium, gallium, neodymium, tellurium…) needed to fuel the growth of renewable energy sectors will not just be maintained, but will grow steadily in the years ahead.

Electric Cars

The world of tomorrow also belongs to electric cars. Indeed, 2020 marked a paradigm shift in auto consumption. While the European automotive market as a whole posted a decline of 4% in December, the electric cars market (EVs + chargeable hybrids) grew by 254%, reaching a market share of 23% (14% for all-electric cars and 9% for chargeable hybrids). Once again, these figures require context: The huge increase in sales of the VW ID3 appears to have resulted from registrations carried out by VW to meet CO2 emissions objectives for 2020 (in order to reduce VW’s payments of that fine that the group is still the only manufacturer to face). Nevertheless, the shift in favour of EVs is real and significant.

In China, the market share for EVs is approaching 10%, and there is no doubt that in the US the Biden presidency should bring about a significant step change in the deployment of renewables and EVs. According to BloombergNEF, the global EV fleet is expected to grow by 4.4m units in 2021 – a 60% increase relative to 2020 (with a current global fleet of 10m units).

The overall production of EV batteries (in which cobalt remains an unavoidable ingredient, in all models) rose by 117% in 2020 to 17GWh. And we are only at the start of the exponential curve.

Our Outlook

The short-term view is sobering. The coronavirus and its new variants will probably continue to impact supply and demand in alternation. Shocks to supply (from a new lockdown in South Africa for example) and to demand (Further restrictions in Europe? A second wave in China?) could mean metals markets swinging rapidly one way or the other, making ours a difficult environment to navigate.

In the medium term however, there is more clarity: We are embarked in a new stage in the fight against climate change and nothing since Trump’s departure appears to pose a threat to this new momentum. Joe Biden’s commitment this week to doubling down on his coutry’s commitment to cutting carbon emissions by 2030 is a welcome indicator of this drive towards change.

According to Goldman Sachs, redistributive policies (bringing about a higher propensity among historically disadvantaged groups to consume more), massive investment in renewable energy, and a return to the creation of strategic stocks, should all contribute to the re-emergence of an ongoing bull cycle for raw materials, and for metals in particular.

The demand for rare metals is likely to grow until the threshold of by-product availability is breached, at which point rare metals prices could rise to unprecedented levels. To invest in rare metals is likely to become a more and more attractive prospect as the year progresses: As we’ve argued, a return to a period of inflation together with an increase in monetary risk are likely to mark out tangible assets such as rare metals as choice instruments for risk securitisation.