Molybdenum is an alloy metal widely used for its contribution to the hardness and resistance of steels, and is essential to many industrial sectors: Its criticality for the extraction, transport and use of fossil fuels, as well as for latest generation military applications, make molybdenum a crucial strategic metal. Nonetheless, without the emergence of new major geopolitical tensions, molybdenum production appears to be able to meet global short-term needs. Thus, currently molybdenum is a rare metal with weak prospects for a price increase, but it could prove to be a wise physical investment if its price continues to fall, providing investors with a good entry point. It is therefore a metal to follow closely.

What is molybdenum?

Molybdenum, chemical symbol Mo, is a transition metal with atomic number 42. It belongs to group VI of the periodic table, with namely tungsten and chromium. Molybdenum is silvery white in color and is renowned for its exceptional refractory properties. Indeed, molybdenum has a very high melting point (2620 ° C), while having a moderate density (10.22 g / cm-3) unlike other refractory metals. This makes molybdenum a minor metal of choice for many applications.

The molybdenum content by mass in the Earth’s crust is 1.2 ppm (parts per million – 10,000 ppm correspond to 1% by mass, so 1.2 ppm represents 0.00012% of the Earth’s crust). It is the 58th element by order of abundance. It is fifty times less abundant than copper, with which it is often associated in porphyry-type deposits, but still fifty times more abundant than gold.

Molybdenum is a member of the “rare metals” family, but it remains a relatively abundant element with substantial production, amounting to 270,000 tonnes in 2018. As a copper by-product for half of its production, particularly in Chile and in Peru, it is also mined in dedicated molybdenum mines, mainly in China and the United States. Molybdenum can be associated with rhenium, a rarer and more strategic metal, particularly for aeronautics and defense. The molybdenum market is valued at around $ 8 billion.

History of molybdenum

Though molybdenum ores have been known since Antiquity, they were at the time confused with those of lead, due to the ductility and the shiny appearance of molybdenum. Thus, the name of molybdenum derives from the ancient Greek molybdos, which means lead. The main ore of molybdenum, molybdenite (MoS2), was identified in 1778 by the Swedish chemist Carl Scheele. Three years later, another Swede, Peter Jacob Hjelm, isolated pure molybdenum by roasting molybdenite.

More than a century later, in 1894, it was at the Schneider factories in Le Creusot that the first molybdenum steels for shielding were produced. The industrial production of molybdenum took off from 1909, then used in the filaments of incandescent bulbs.

Molybdenum applications

In addition to its refractory properties, molybdenum has the lowest coefficient of thermal expansion of all metals, as well as excellent thermal conductivity. Ferroalloys therefore constitute more than three quarters of molybdenum demand, for which it improves hardness, high temperature performance, mechanical strength, as well as resistance to corrosion and fatigue.

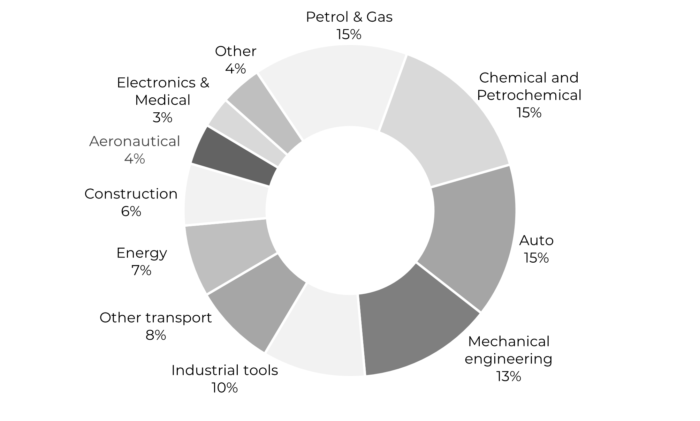

Source: IMOA, 2018

In practice, molybdenum is added in small quantities in many steels, with contents ranging from 0.2% up to 2% for stainless steels. These steels are used for the most part in the oil and gas industries as well as in the automotive industry. Indeed, improving the hardness and resistance of steels with molybdenum is crucial for the drill pipes used for oil and gas extraction, but also for the entire network of tubing associated with their operation and their transport. In the automotive industry, it is the weight reduction provided by molybdenum that is sought after, in addition to the strengthening of certain parts of the engine and transmission. Steels containing molybdenum are also popular in construction (tunnels, bridges), in power generation (nuclear power plants, steam and gas turbines) as well as for the manufacturing of tools.

Molybdenum is widely used in certain chemicals: lubricants, paints, pigments, and as a catalyst, especially in the petroleum industry.

Molybdenum is also used as a pure metal for its specific physical properties in certain high-tech fields, for example for the manufacture of semiconductors, anodes for X-ray emission in the medical sector, LCD and touch screens, lamps, and diodes.

The aviation and aerospace industries also use molybdenum in nickel-based alloys, also known as “superalloys” for their resistance to high temperatures. Molybdenum is widely used by engine manufacturers in superalloys intended for military use, as these alloys provide performance and high strength, but these alloys are also used in civil aviation. Superalloys are used in aircraft engines, where we find the highest heat and mechanical stresses in engineering. Indeed the disks, blades and shafts of an aircraft engine’s turbine or compressor must maintain in-service functionality with operating temperatures of up to 1400 ° C on repeated cycles, conditions in which conventional steels would deteriorate prematurely. Lightening structures are also a major and growing issue in aeronautical design, to which molybdenum contributes.

Present in a great range of applications, molybdenum is therefore a critical metal for a number of fields, and in particular the petroleum sector (see graph below). In addition to the properties it provides, it is also rarely substituted because of its currently competitive cost. The molybdenum recycling rate is currently quite low, around 25%, and mainly during steelmaking.

Source: General Moly, 2019

Investing in molybdenum

Market

Since 2010, molybdenum has been publicly listed on the London Metal Exchange (LME) where it is possible to buy molybdenum futures contracts. It is also possible to invest in mining companies specializing in molybdenum, such as Molymet, listed in Chile, Climax Molybdenum, a subsidiary of the American Freeport-McMoRan, or China Molybdenum, listed in Hong Kong and Shanghai. Finally, there is the solution of investing in molybdenum via physical purchase.

Supply

Although almost half of known reserves are located in China (and none in Europe outside Russia), the criticality of molybdenum remains low in the short term because the supply of molybdenum is distributed among several mining companies in various countries.

However, China, the world’s largest producer, saw its production drop by 27% between 2015 and 2018 and this trend seems to be continuing. Several factors explain this phenomenon:

- Slowdown in domestic demand

- The fight against pollution generated by mining wastes

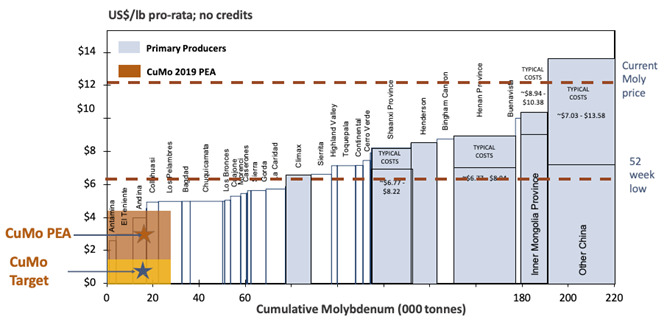

- Chinese production costs higher than the competition elsewhere in the world because molybdenum is produced there as a primary product. the production costs of Chinese molybdenum mines (from $ 6.7 / lb to more than $ 10 / lb ) are higher than those of other producers (between $ 3 / lb and $ 6 / lb) for which molybdenum is mainly obtained as a by-product of copper (see graph below).

Source : American CuMo, Economics, 2019.

As a result, and specifically due to the drop in Chinese production, world production has fallen by 10% since 2014. This phenomenon has been accentuated by COVID, which, by impacting copper production, has also impacted that of molybdenum.

However, the demand for copper, a key metal in electronics and a central player in the energy and digital revolution, could increase significantly in the short term, changing the balance in the molybdenum market. Indeed, while the share of molybdenum production as a copper by-product represented about half of total production ten years ago, this share is rising sharply and now represents, according to the Roskill agency, 73% of total production in 2019. This implies that the metal has seen its price elasticity of supply drop considerably in recent years.

Demand

There are real uncertainties regarding the demand for molybdenum. Despite the fact that post-COVID stimulus plans announced around the world target the most molybdenum-intensive sectors (oil and gas, aeronautics, automotive, construction), those plans currently have considerable limitations.

Since molybdenum is an alloy metal with relatively limited prospects in terms of new emerging applications in the coming years, its consumption follows that of its key sectors. The fall in oil investments announced for 2020, around $ 100bn less than in 2019 according to Rystad Energy, suggests a sharp drop in demand for molybdenum, especially since this fall in investments is likely to continue in the short term.

Outlook

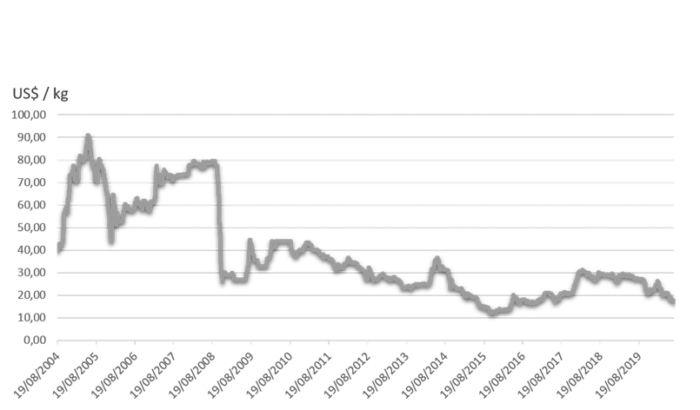

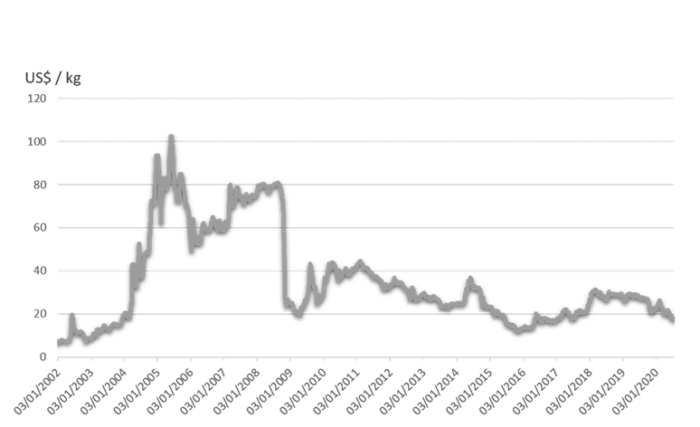

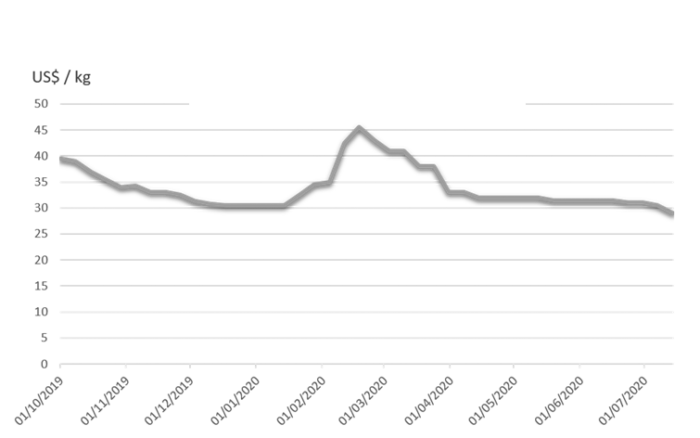

Technical molybdenum oxide (used for ferroalloys) is currently trading around $ 17 / kg, 30% higher than its lowest price reached in late 2015, but only 55% of its all-time high in March 2018. Here are the price histories of the different forms of molybdenum, published by Argus Metal:

Aug 2004 – Jul 2020

Jan 2002 – Jul 2020

Aug 2019 – Jul 2020

With demand for molybdenum currently impacted by the crisis and production that is relatively stable, since it is essentially obtained as a by-product of copper, molybdenum prices do not seem likely to increase sharply in the short term. Molybdenum nevertheless currently stands at a very interesting price historically speaking. And this, because of the criticality of molybdenum for essential applications, makes it a very interesting rare metals investment opportunity in the medium to long term: One to watch.

Sources

- L’élémentarium, fiche de l’élément molybdène, 2019.

- IMOA : International Molybdenum Association, 2018, www. imoa.info.

- BRGM, Panorama 2010 du marché du molybdène, Octobre 2011.

- American CuMo, Economics, 2019.

- Argus Metal, 2020.